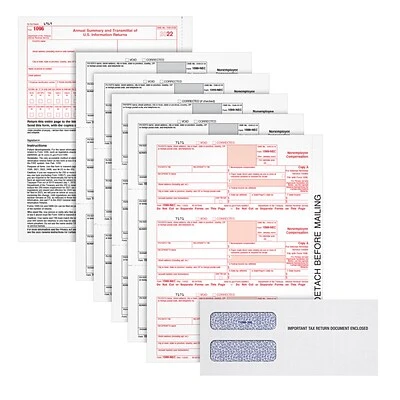

TOPS 2022 1099-NEC 5-Part Laser/Inkjet Tax Forms & Envelopes, 100 Sets/Pack (LNEC5KIT-S)

$61.99 Original price was: $61.99.$43.39Current price is: $43.39.

- 7-Day Returns, 100% Quality

- Quality at its Finest

- Secure Shopping with Safe Payments

- Efficient and effective customer service, online.

For over 35 years TOPS has been helping companies fulfill their tax and business form needs.

For over 35 years TOPS has been helping companies fulfill their tax and business form needs. 1099-NEC forms can be used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to nonemployees, receipts of medical and health care payments. Their years of experience working closely with the IRS guarantees the accuracy of all specifications and IRS compliance.

For over 35 years TOPS has been helping companies fulfill their tax and business form needs. 1099-NEC forms can be used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to nonemployees, receipts of medical and health care payments. Their years of experience working closely with the IRS guarantees the accuracy of all specifications and IRS compliance.

-

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

-

Five-part kit includes copies A, B, C, 2 & C, 1096 forms, and double-window envelopes

-

Tax forms are inkjet and laser printer compatible

-

100 sets per pack

-

Product dimensions: 11″H x 8.5″W x 0.5″D; sheet size: 8.5″ x 11″

-

The new 1099-NEC will capture any payments to nonemployee service providers, such as: independent contractors, freelancers, vendors, consultants and other self-employed individuals (commonly referred to as 1099 workers

-

The 2022 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2022

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets or exceeds IRS specifications

-

Accounting software and QuickBooks compatible

For over 35 years TOPS has been helping companies fulfill their tax and business form needs. 1099-NEC forms can be used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to nonemployees, receipts of medical and health care payments. Their years of experience working closely with the IRS guarantees the accuracy of all specifications and IRS compliance.

| Acid Free | |

|---|---|

| Brand | TOPS |

| Customizable | No |

| Height in Inches | 2 |

| Length in Inches | 11 |

| Pack Qty | 100 |

| Parts | 5 |

| Tax Form Pack Size | 100 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 51+ |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “TOPS 2022 1099-NEC 5-Part Laser/Inkjet Tax Forms & Envelopes, 100 Sets/Pack (LNEC5KIT-S)” Cancel reply

Related products

Sale!

Sale!

1099 Miscellaneous Forms for Laser Printers

Reviews

There are no reviews yet.